This May was the 125th anniversary of the Dow Jones Industrial Average (DJIA). That makes it the second oldest index of stocks globally (behind the Dow Jones Transportation Index). While you can't trade an index by itself, there are financial instruments that track the index performance – there is over $7.6 trillion invested in these passively managed exchange-traded funds.

Why is the Dow Jones a lousy indicator of the overall health of the economy?

First, it was created in 1896 by Edward Jone to track the performance of the 12 largest industrial companies, eventually expanding to 30 U.S. companies. The criteria for being included in the index was to be "a large and respected company," the first red flag.

Indices are typically weighted. Otherwise, they would be disproportionately weighted towards smaller companies. The S&P 500, the gold standard in indices, uses a market capitalization-weighted system, so larger companies make up proportionally a more significant part of the index.

The DJIA uses a price-weighted index. Why is this bad? Companies have different amounts of shares outstanding, so price itself isn't a good indicator of the company's total value in the stock market (Berkshire Hathaway Class A stock trades at around $420,000, while Apple trades around $150). This means that DJIA overweight small stocks. For example, Travelers Companies is the smallest stock by market capitalization in the DJIA but is the 17th highest-ranked company in the portfolio.

Price-weighted also means that DJIA is incorrectly affected by stock splits. For example, Apple went from being the highest weighted stock in the portfolio, at ~11%, to number twenty-two at ~2.5%. This shift happened because Apple went through a stock split last August, and the price of the stock was adjusted.

DJIA doesn't include some of the biggest companies today. For example, Amazon has a $1.8 trillion market capitalization but isn't included in the index. However, DJIA does occasionally add new companies. For example, last year, it added Honeywell but removed Pfizer.

Index funds are a great way to diversify your portfolio, but there are so many better ones today. When you hear that the DJIA is performing especially well or poorly, know that it isn't an indicator of much.

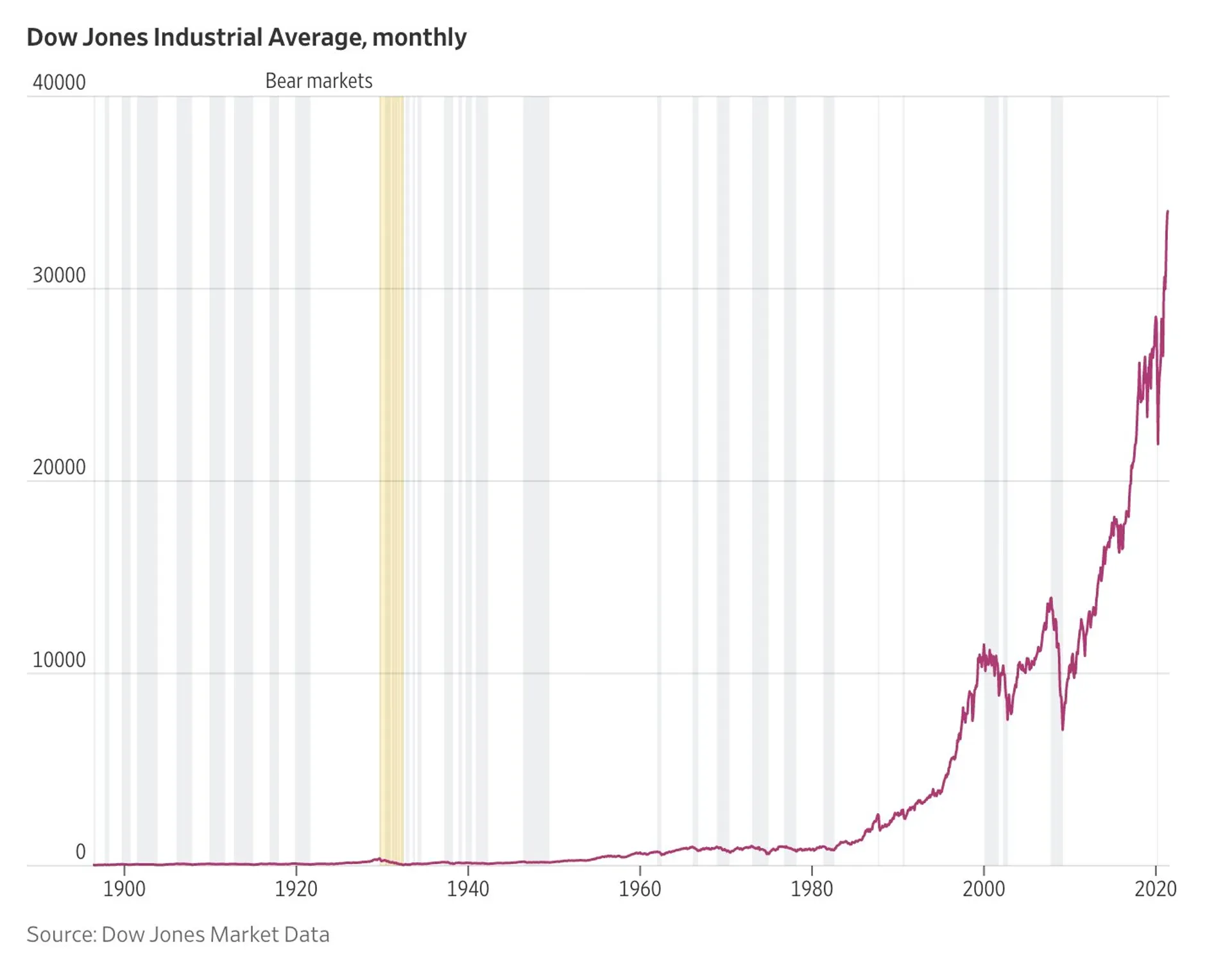

Finally, a fun fact: if you invested $1 in 1896 and reinvested your dividends, you would have made around $187,000 today, or an average of about 10% per year for the last 125 years.