One of the most important SaaS metrics is net dollar retention (NDR).

Net dollar retention is the percentage of recurring revenue retained from existing customers over a period.

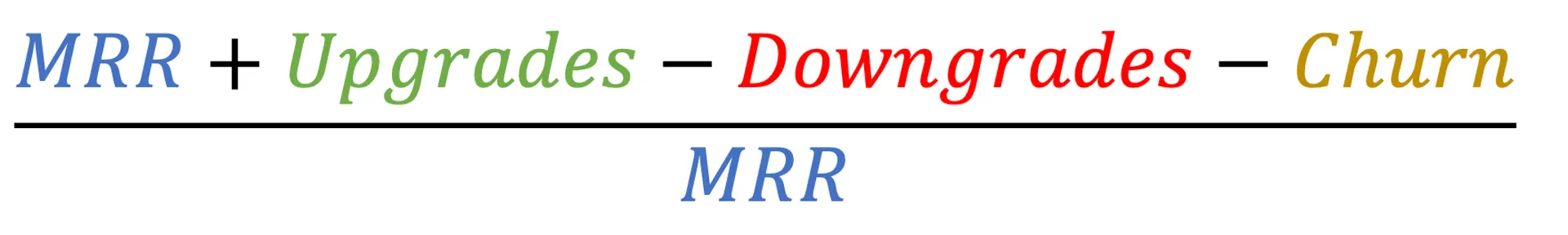

It can be calculated by summing up revenue, upgrade revenue - downgrade revenue less churned revenue all divided by revenue over a certain period for a cohort, usually last month or last year.

You might also see NDR referred to as dollar-based net retention rate or net expansion rate.

Why is it important? NDR gives a high-level overview of how revenue is affected by two other important components of SaaS companies: expansion (upgrades/downgrades) and churn.

Measuring net dollar retention helps us unpack the health of our revenue, even if it is increasing. For example, imagine a company that continues to acquire new customers while old customers are 1) downgrading their plans or 2) canceling their plans.

How do you increase net dollar retention?

- Customer success. Use customer success to reduce churn. Increasing product usage and educating users about getting the most value out of your product can go a long way in reducing churn.

- Upselling. After new customers are hooked, they should expand into more of your product offerings. Customer success organizations help here as well.

- Pricing. Setting the right pricing tiers and pricing programs can go a long way in making sure customers are scaling their contracts with their usage. For example, does your product lend itself to usage-based or volume pricing?

What's a good benchmark?

The average net dollar retention for public SaaS companies is ~115%. Anything less than 100% for enterprise SaaS companies means there's trouble.

High net dollar retention can let companies spend more on sales and marketing efforts since one dollar of customer acquisition costs will generate a higher lifetime value.

Great Examples

Twilio has sustained high net dollar retention (~140%) despite growing to nearly $2B in ARR. What's working? Expansion revenue through Twilio's suite of communication products. Usage-based pricing that scales with its largest customers. A bonus is that Twilio has continued to serve its smaller customers since usage-based pricing makes the product accessible for them as well.

Snowflake is the poster child of net dollar retention (currently 169%). As a product with heaps of data gravity, it's difficult for customers to churn. In addition, Snowflake's typical customer is a high-growth startup, which will continue to expand through volume-based pricing.

Other considerations

Again, there's not a strict standard on the period that you use. Some companies report it over the last twelve months. So picking your cohort is important. Some companies will count contracted ARR, but in my opinion, that doesn't count.

Different stages of companies might focus on different aspects of NDR. For example, a company that hasn't expanded outside its core product won't stress too much about the lack of expansion revenue (today).