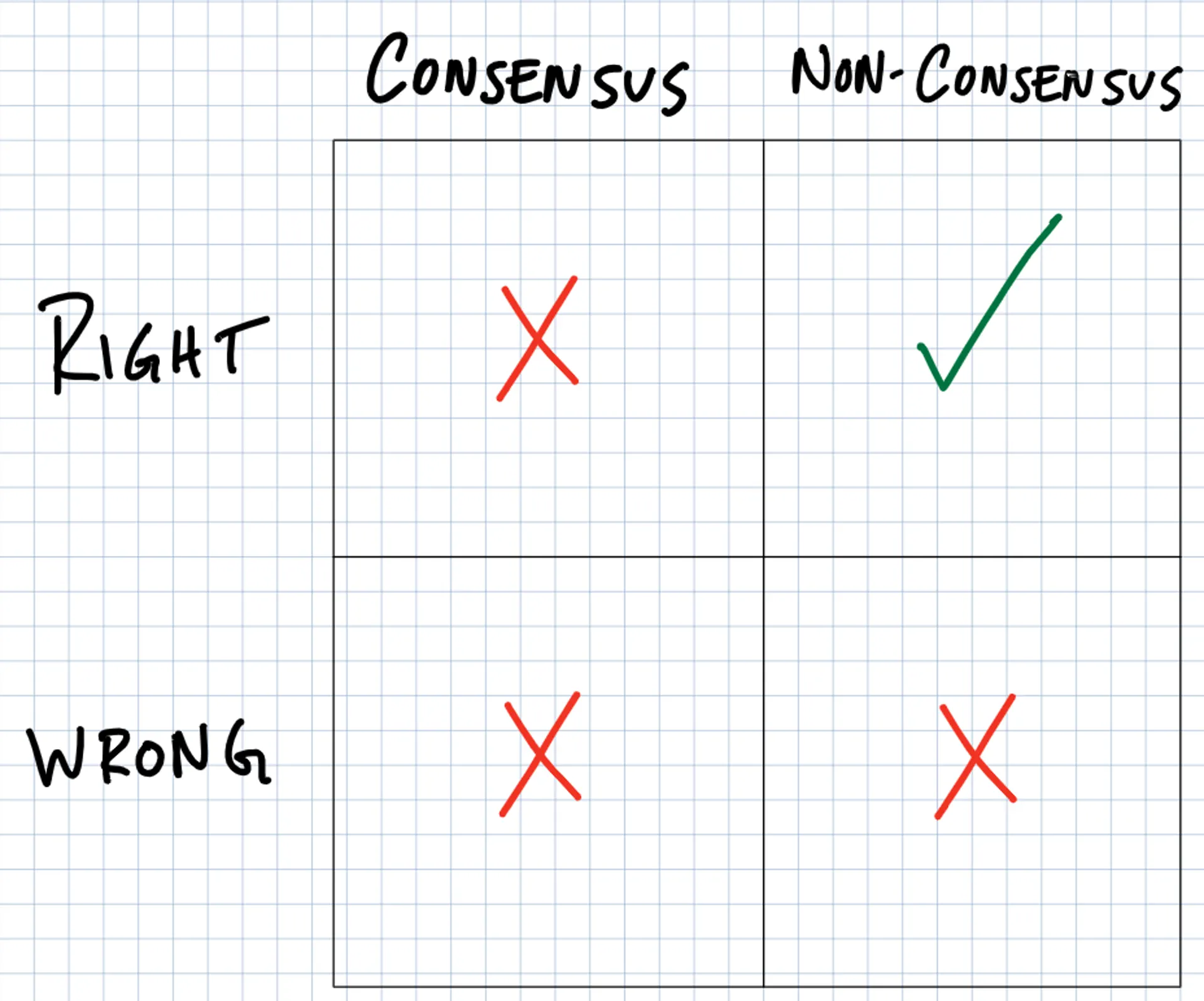

The secret to building great and lasting businesses is to be non-consensus and right.

If you are wrong, you don't make money. Even worse, if you're wrong and non-consensus, people might think you aren't very bright. But being right isn't enough. The idea might be too obvious if you are consensus right, and you might find yourself with dozens of fast-follower competitors. Following the crowd rarely creates outsized returns.

Non-consensus gives you the time to test your ideas and iterate through trial and error. Some of the best non-consensus ideas come from asking yourself, "what do I know that few others do?"

Some of the best investors use this framework. Andy Rachleff, a co-founder of Benchmark Capital and CEO of Wealthfront, looks for this in startups (and teaches it at Stanford). Howard Marks says that superior performance comes from accurate non-consensus forecasts. Warren Buffet hosts the annual Berkshire Hathaway shareholders meeting, a pilgrimage for self-described contrarian thinkers.

It's easy to tell which ideas are consensus or non-consensus. The more challenging part is figuring out which ones are right. The thing about contrarians – is they are usually wrong.