Every year, Okta (an identity SaaS platform) publishes a report on popular SaaS applications in the workplace. Since Okta is an authentication provider, it can use verifications and authentications to gauge usage of different SaaS applications in the workplace. Here's some interesting graphs from the report (read the full report here).

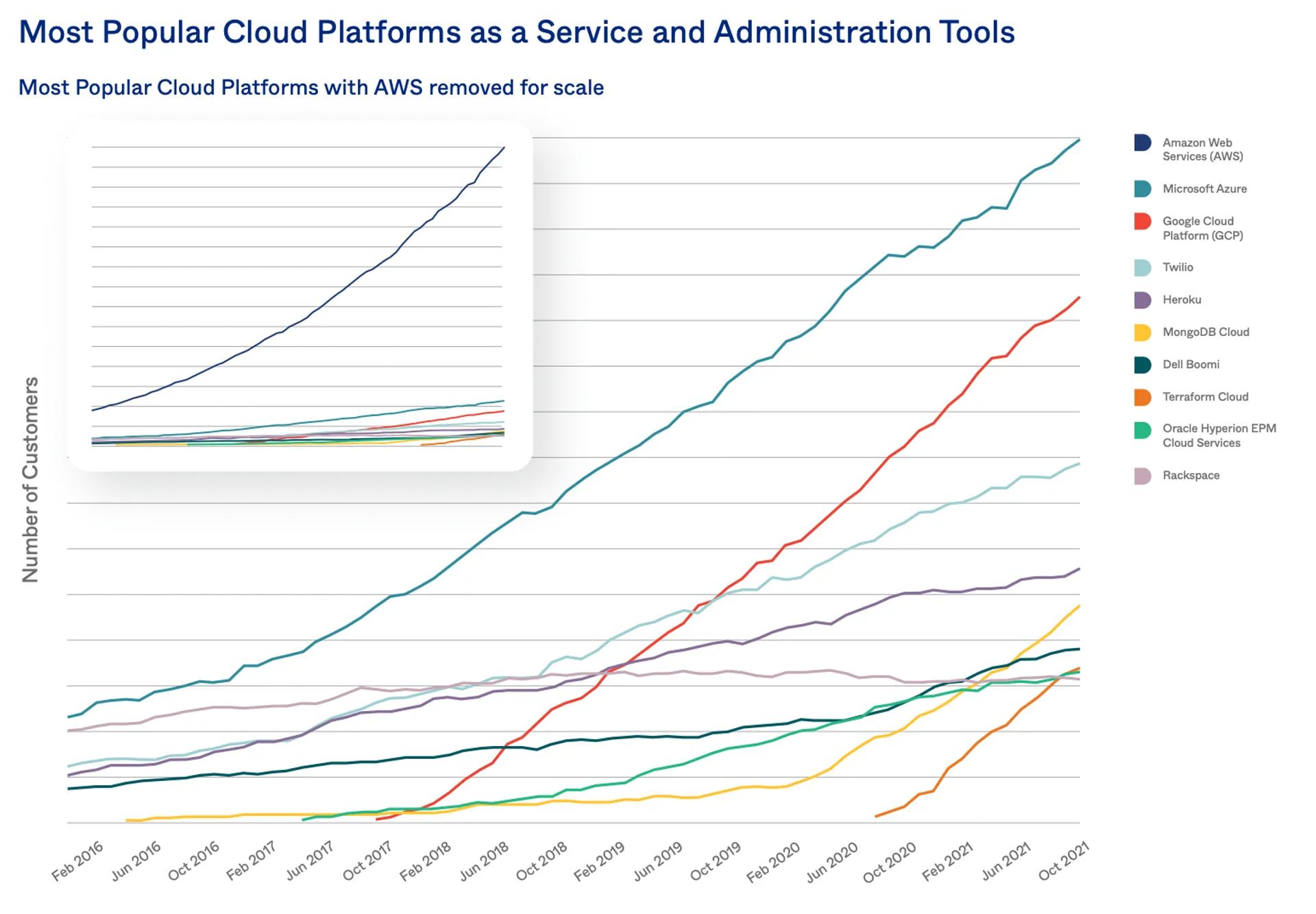

First the sheet dominance of AWS in cloud platforms – it needs its own scale. A caveat here is that Google Cloud and Microsoft are most likely underrepresented in Okta's survey as it competes with Azure AD and Google Cloud IAM. Another interesting point to note is the lack of inflection points during COVID. Did cloud platforms not see the same digital acceleration as SaaS?

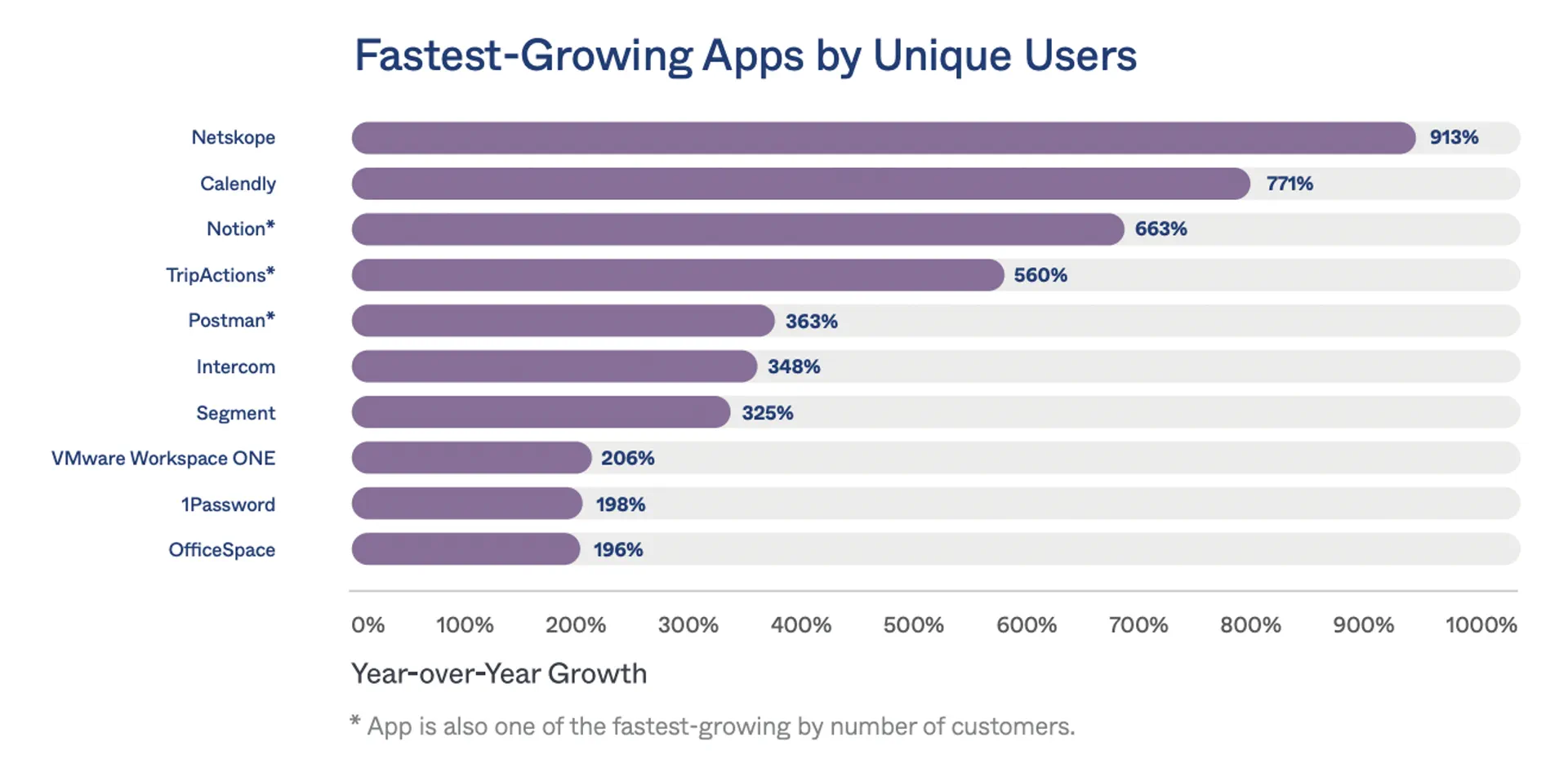

TripActions, a corporate travel platform, has continued to accelerate as travel resumes. The company was close to death, raising a large debt round at the beginning of the pandemic. Now it's at a $7.25B valuation.

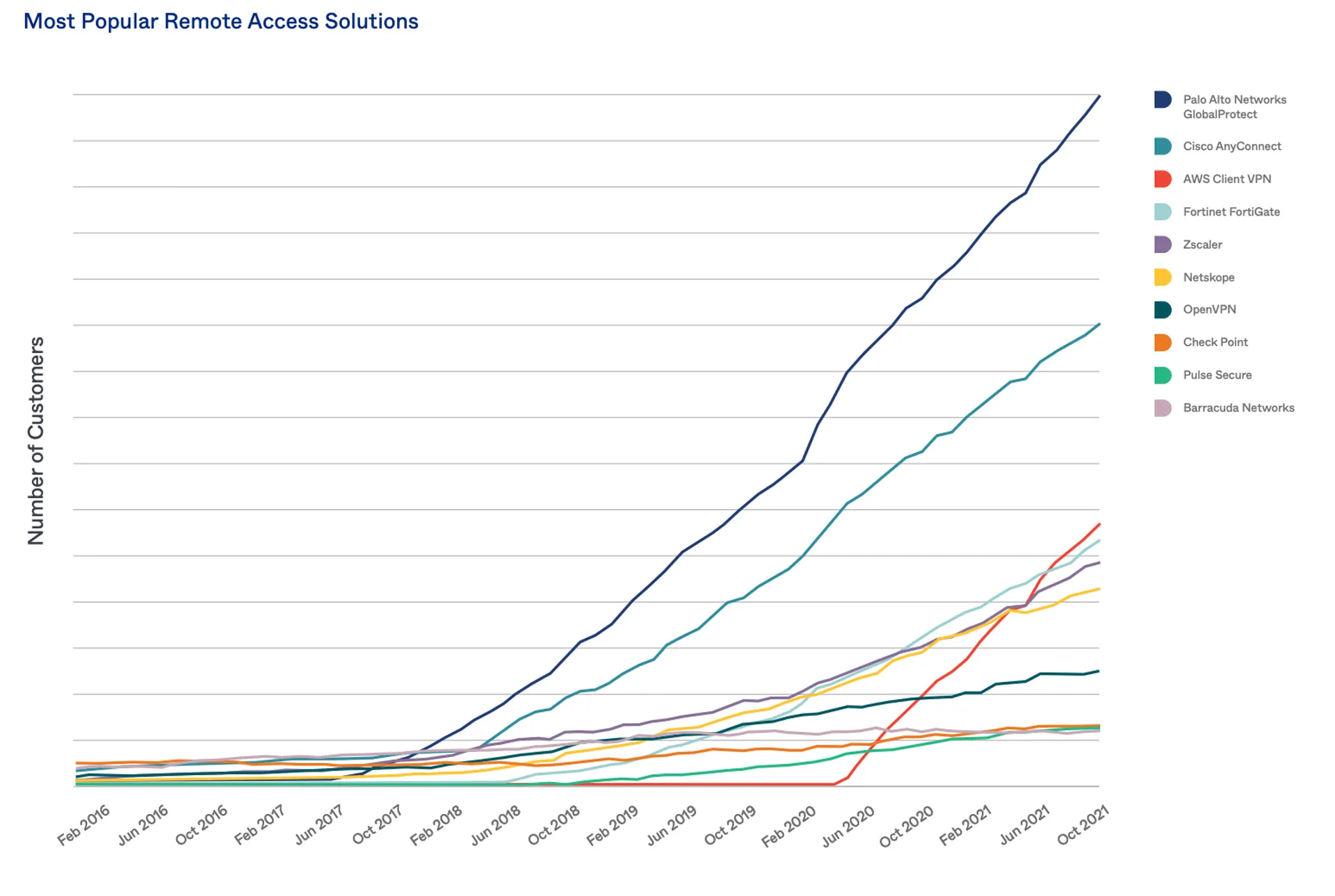

VPNs found themselves with two inflection points: the rise of easy-to-configure and fast protocols like WireGuard, and a global pandemic forcing work-from-home. AWS Client VPN isn't a great solution, but its convenient and integrated. Will be interesting to see how upstarts like Tailscale compete here.

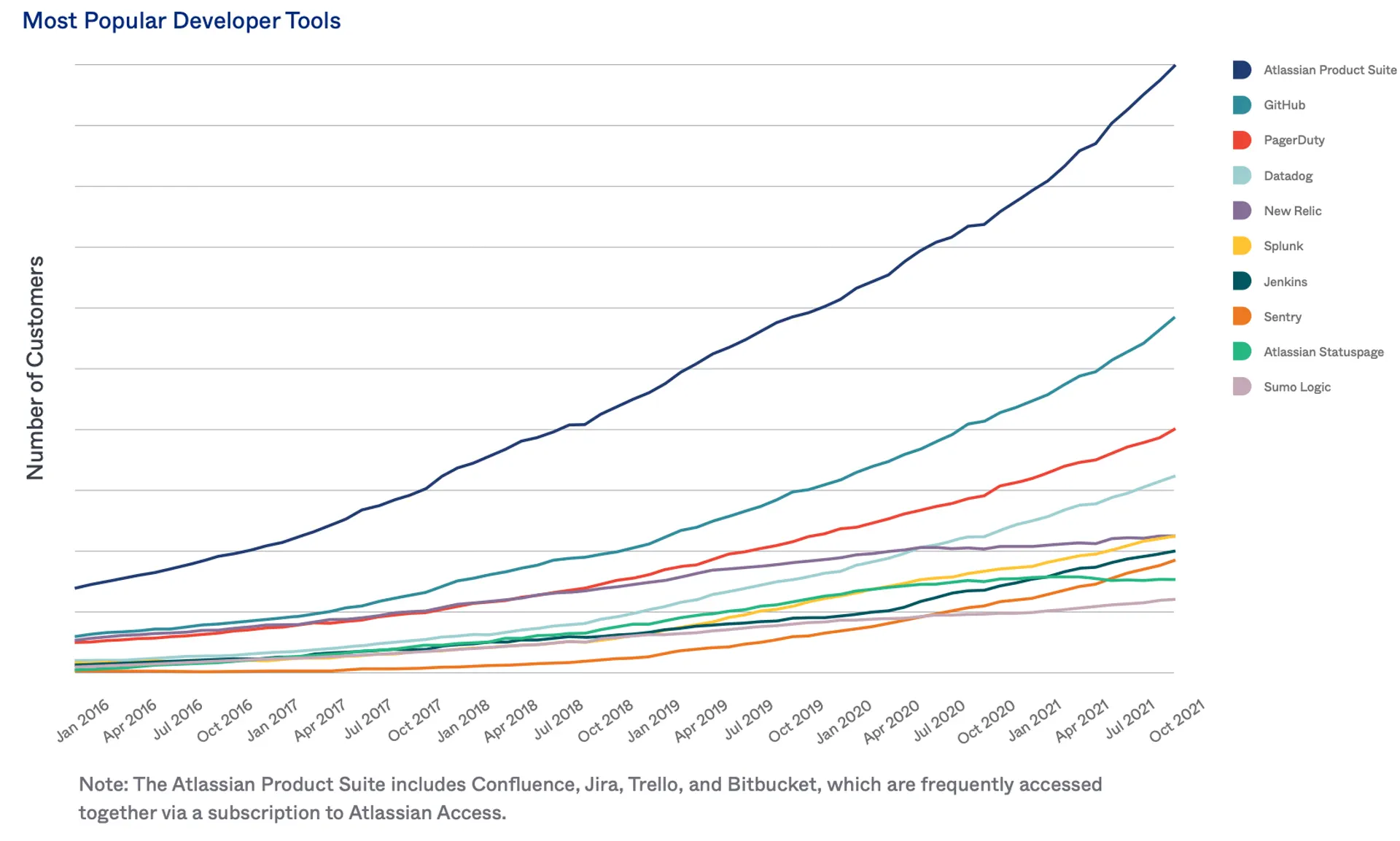

Finally, Atlassian continues to be the top developer tool. As I wrote in Code or Issues in DevOps Platforms, there's a case for GitHub becoming the system of record in software project management. But Jira has decades of UX built into it (do users hate the product or all the work the product tells them they have to do?).