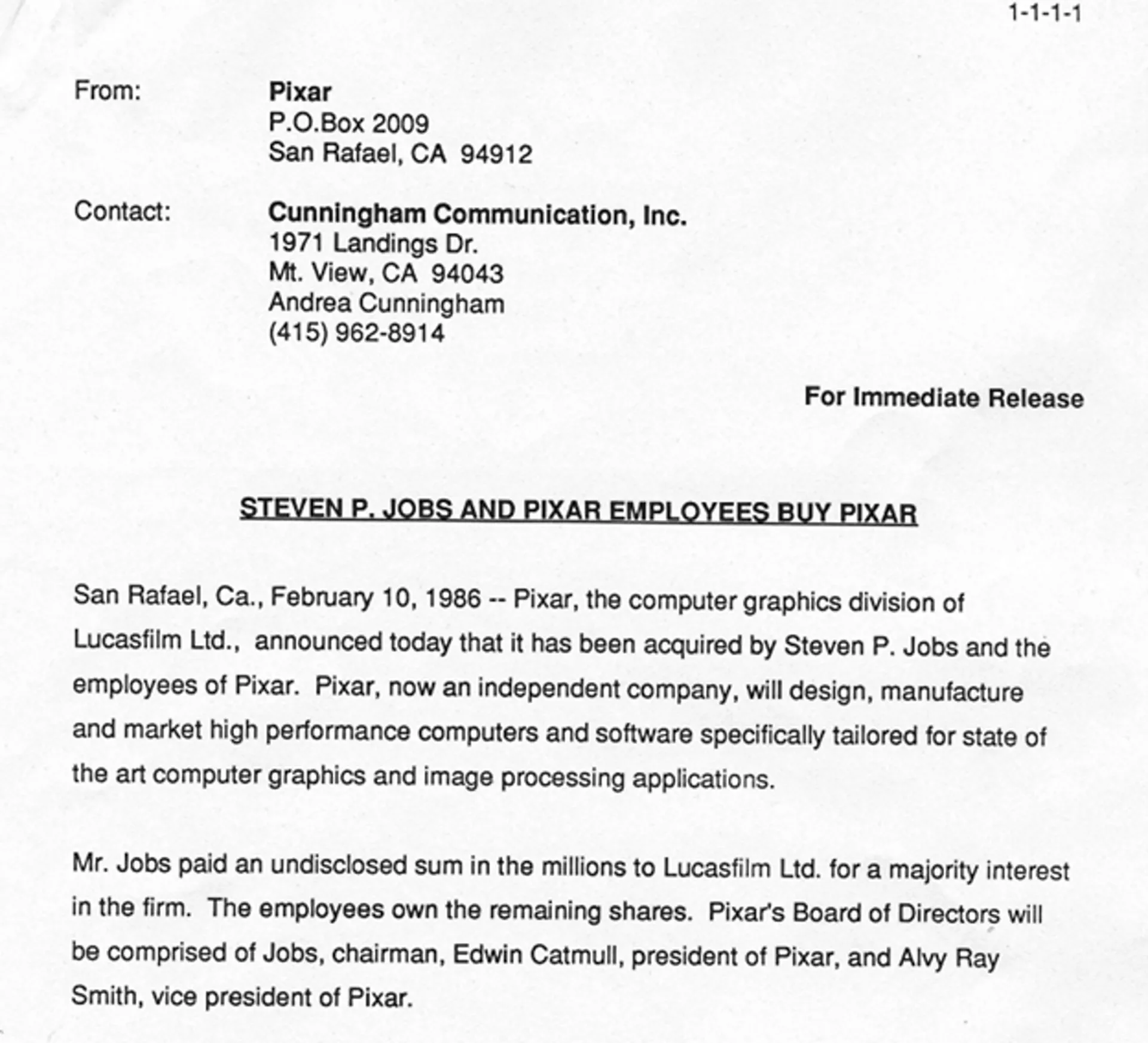

Pixar has a fascinating history. It's a story of big dreams, big bets, and considerable outcomes. Pixar went from just two computer scientists to a standalone company to nearly bankrupt to a surprising IPO to an even more significant acquisition. The complex corporate history led to puzzling press releases like, "STEVEN P. JOBS AND PIXAR EMPLOYEES BUY PIXAR." On top of that, it may have been one of the greatest venture investments ever done by a single investor.

Ed Catmull and Alvy Ray Smith, two computer scientists formed a company called NYIT in 1975 on Long Island to work on computer graphics. They dreamed of one day creating the first completely digital movie.

In 1977, fresh off the success of the first Star Wars movie, George Lucas was looking for computer graphics experts to do work on the sequels. So Lucas brought in Catmull and Smith to work exclusively on the hardware and technology for Lucasfilm.

In 1986, Lucas was looking to spin off 40 employees who made up Lucasfilm's computer graphics group. Apple had recently fired Steve Jobs after a power struggle with John Sculley. Jobs capitalized the newly formed company with $10m for 70% ownership. Of that $10m, half of it went to Lucasfilm to obtain the exclusive rights to the technology. This deal led to the peculiar headline, "STEVEN P. JOBS AND PIXAR EMPLOYEES BUY PIXAR." The company included Catmull and Smith and John Lasseter, an animation genius who only two years earlier had been fired by Disney for his push for CGI in animation.

Pixar was not an early success. It was failing as a hardware company. Yet, Jobs was determined to avoid any perception of failure after he was ousted from Apple. He continued to pour money into the business by buying equity from early employees. By 1991, Jobs owned 100% of Pixar at a total investment of $50m.

While accounts may dispute Jobs' involvement in Pixar, he could take advantage of opportunities when they arose. Amazingly, a hardware studio that had only produced a few shorts could do a deal with Disney for Toy Story. Disney paid for the production, and the launch of Toy Story would set Pixar up for an excellent IPO.

Jobs would eventually carve out an option pool, but he still owned almost 80% of the company at the IPO. On the IPO day, Pixar closed at $39/share for a market cap of $1.2b. The wealth Jobs amassed from Pixar's IPO and subsequent sale dwarfed the early fortune he made at Apple.

Rumor says that Jobs called up Larry Ellison and said "I made it" in reference to the "billionaire" club.

Later, in 2006, Disney would acquire Pixar for $7.4 billion in an all-stock deal. Jobs owned 49.65% of Pixar, making him Disney's largest individual shareholder with 7%, valued at $3.9 billion, and a seat on the Disney board of directors. Jobs' Disney share alone would be worth nearly $23b today.

Pixar's story shows how difficult startups can be, even when they are directionally correct. For Jobs, it showed the importance of ownership and narrative.