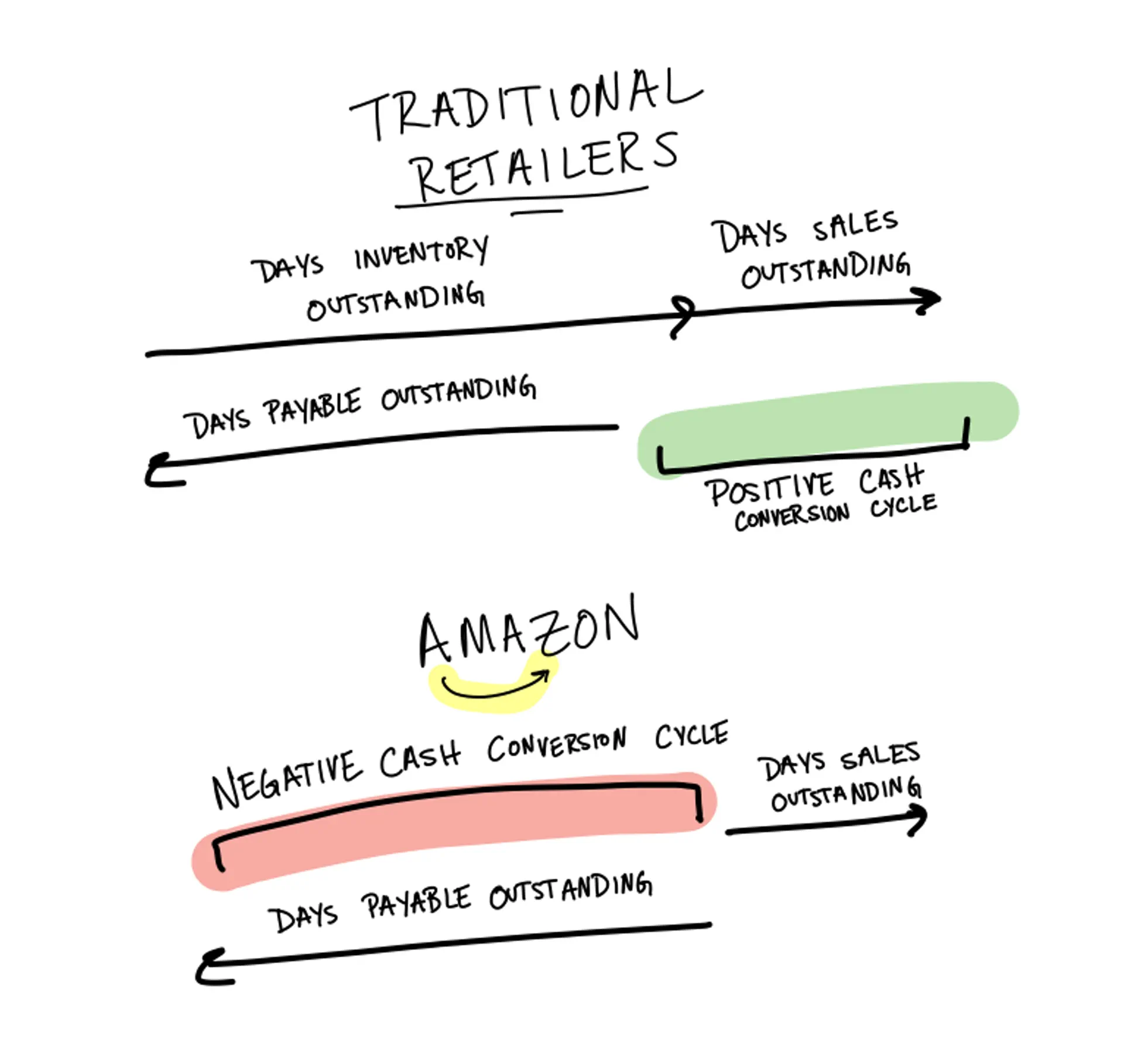

Most businesses buy goods before selling them. Cash flows to suppliers before customers pay and companies have to continually finance that gap - usually one or two months of sales. Amazon is different.

When a customer bought a book on Amazon.com in 1995, their credit card was charged immediately but the book distributors only settled with Amazon every few months. The result: cash on Amazon's balance sheet that could be used to fuel growth and finance its operations, interest-free. To understand how important this was to Amazon, we'll need to define some metrics of working capital. The most important is the cash conversion cycle.

Cash Conversion Cycle (CCC) = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) - Days Payable Outstanding (DPO)

To achieve a lower cash conversion cycle, you need to go through your inventory quickly (DIO), collect payment from your customers immediately (DSO) and maximize the time until you have to pay your suppliers (DPO). Efficient retailers like Costco and Walmart incredibly low CCC at 3 days and 2 days respectively. However, Amazon's CCC is actually negative, at -33 days. In fact, Amazon's CCC has never been positive since the company was started.

Clearly the negative operating cycle gift from the book distributors wouldn't scale as Amazon expanded into different categories. Technology would catch up as well, and payment over the internet would decrease the DPO. Amazon has been able to continue to keep its CCC negative through its market power with Amazon Marketplace Sellers as well as its investments in reducing DIO through its distribution network.

Today, startups are getting creative with how they leverage negative working capital for growth. What worked for Amazon won't work for today's companies. One example is Zola, a wedding-registry website that lets guests purchase items off an online registry. Typically, this transaction occurs months before the wedding, however items aren't deliver until the the wedding date. This delay allows Zola to use those funds as an interest-free loan to finance growth and operations.