One of the inspirations behind my daily writing is Fred Wilson, a venture capitalist, and blogger. He's been writing daily on avc.com since 2003 (although he does weekdays now). I was lucky enough to briefly meet him many years ago at a hackathon I participated in (I was helping my friend build out a recommendation engine).

From 2010 to 2013, he had a series called MBA Mondays, where he covered the basics of business education. Fresh out of business school, I'm now barely qualified to host MBA Mondays myself. I'll mainly be covering topics related to SaaS businesses, and more generally, just software businesses.

First up, the Rule of 40.

What is it? An easy to calculate benchmark for $1m+ MRR SaaS businesses to understand whether or not the business is healthy. It says that a business should either be growing fast or have high margins.

How to calculate it:

Growth Rate % + Profit Margin %

Growth rate is tracked as revenue growth.

For SaaS companies, profit margin is usually calculated by dividing profit by EBITDA.

If you aren't hosting your SaaS on cloud and instead have your own infrastructure, then EBITDA isn't as good of a measure since your operating income will look quite different than your Free Cash Flow (FCF).

As for what period you should choose to calculate these numbers over – Brad Feld suggests tracking year-over-year MRR growth rate to simplifies the equation.

What's the benchmark? A good benchmark is that Growth Rate % + Profit Margin % > 40%, hence "the Rule of 40".

Unpacking the rule: Over time, it's difficult for large software companies to sustain high growth rates.

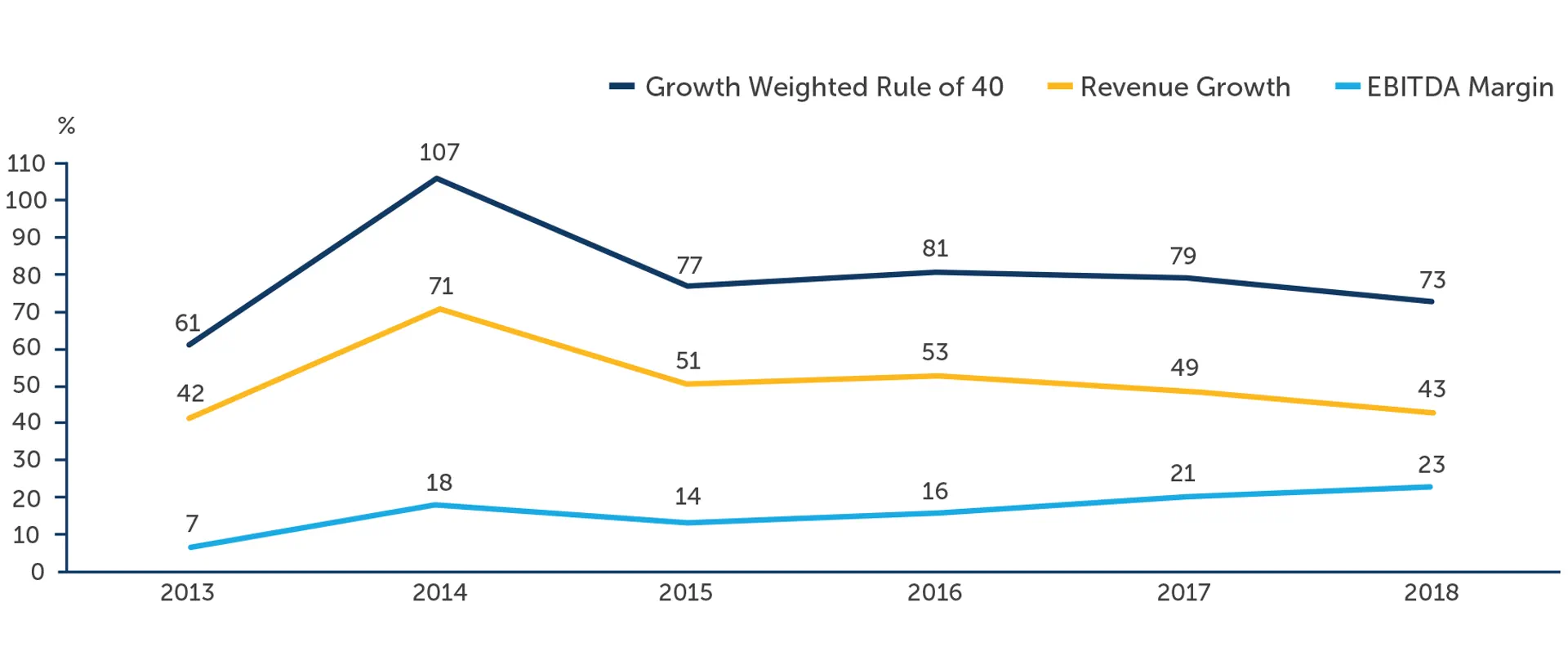

A composite analysis of the same company's Rule of 40 growth rates (using a weighted growth-model) Source: Susquehanna Group

You can see that as companies become more mature, they grow slower but have higher revenue growth. This makes sense: it's challenging to sustain the same growth rate on a larger revenue base.

Public comps: Where do some current SaaS companies stack up against the rule of 40? Using some numbers from Jamin Ball's newsletter, Clouded Judgement (subscribe!) – he calculates the Rule of 40 using the Last Twelve Months (LTM) growth rate + LTM FCF margin.

Snowflake: 102%

Confluent: 23%

MongoDB: 33%

Atlassian: 70%

Elastic: 47%

PagerDuty: 31%

Zoom: 219%

Adobe: 65%

Salesforce: 45%

Variations: Some models give additional weight to the growth component, using something like (1.33 * Growth Rate) + (0.67*EBITDA margin).

The Rule of 40 doesn't apply well to companies below $1m MRR because those early-stage companies tend to have extremely high growth rates and negative EBITDA margins.