Like filling up a leaky bucket, high churn can turn a fast-growing SaaS business into a dying one real quick. I've written about calculating Net Dollar Retention, but when looking to compare public SaaS companies, many calculate the number slightly differently.

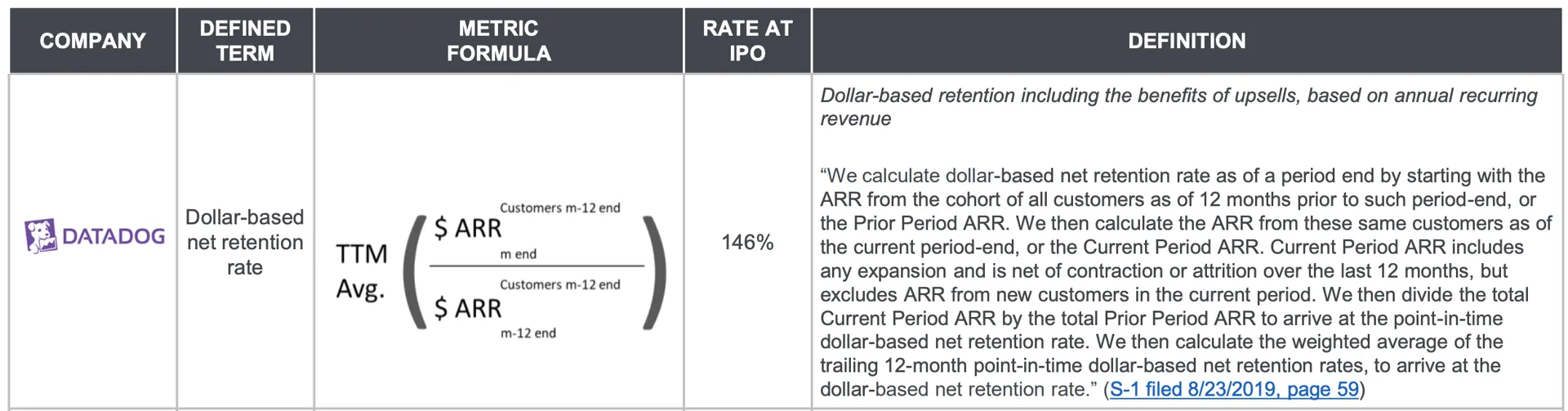

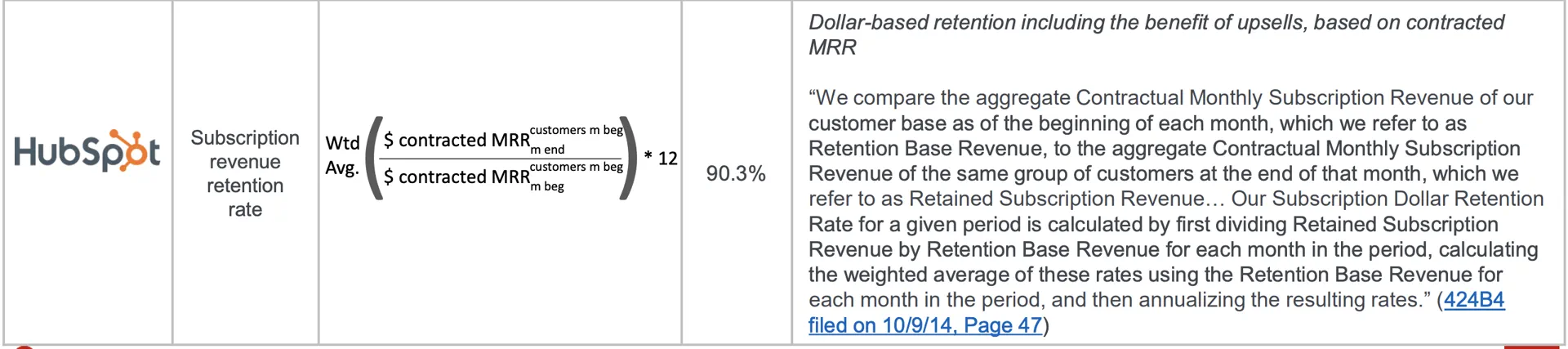

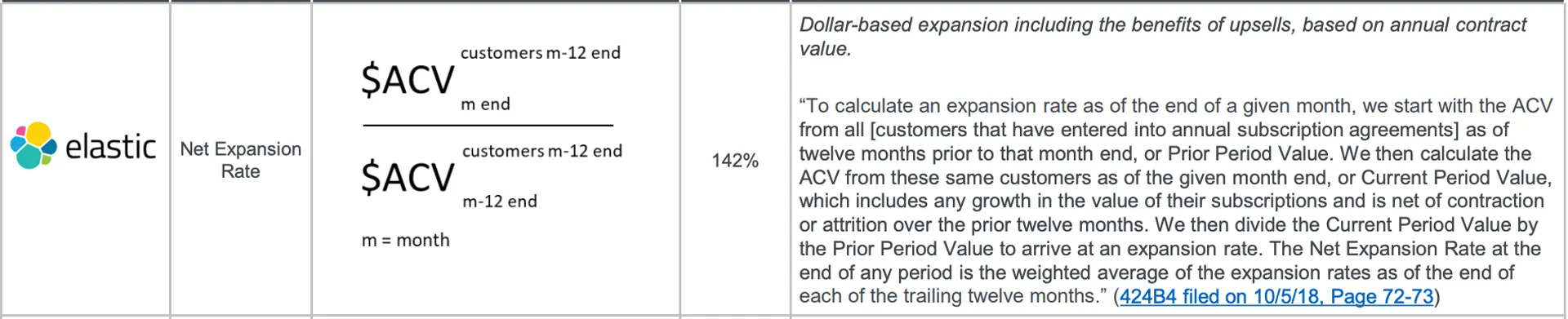

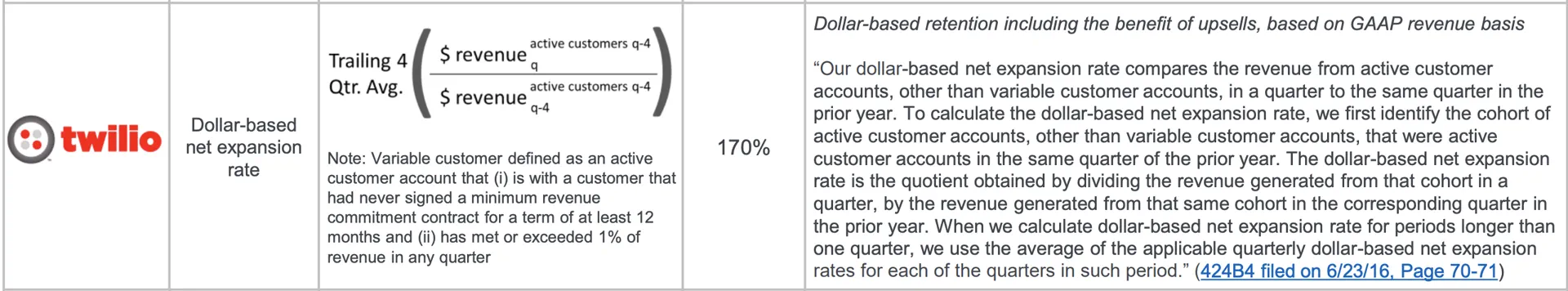

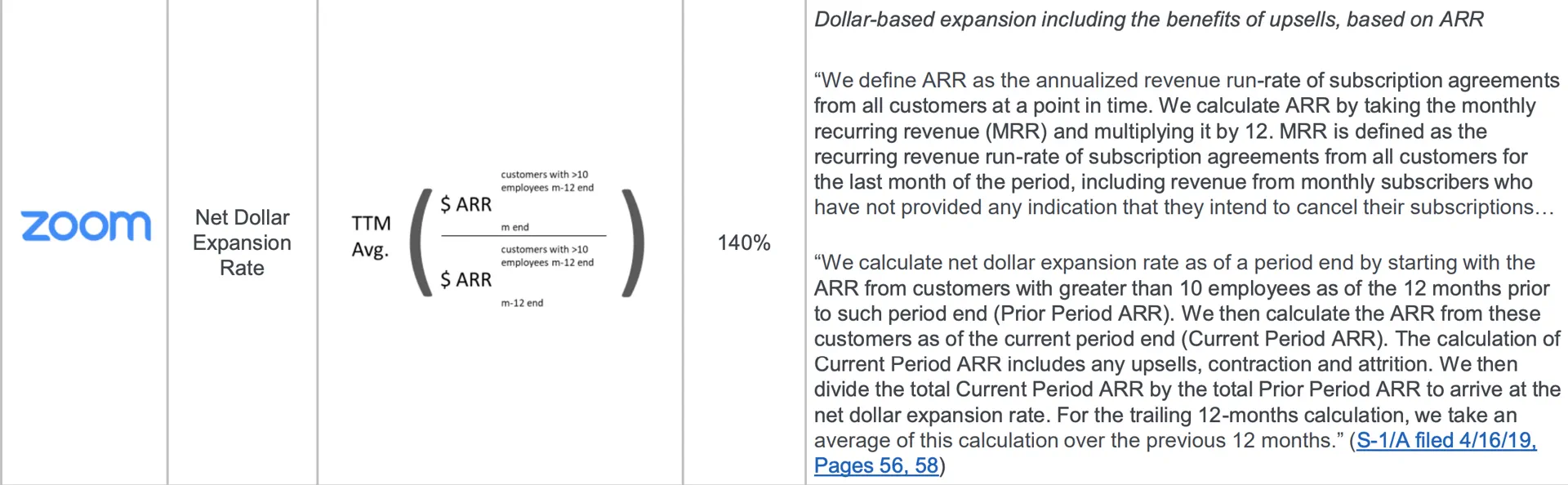

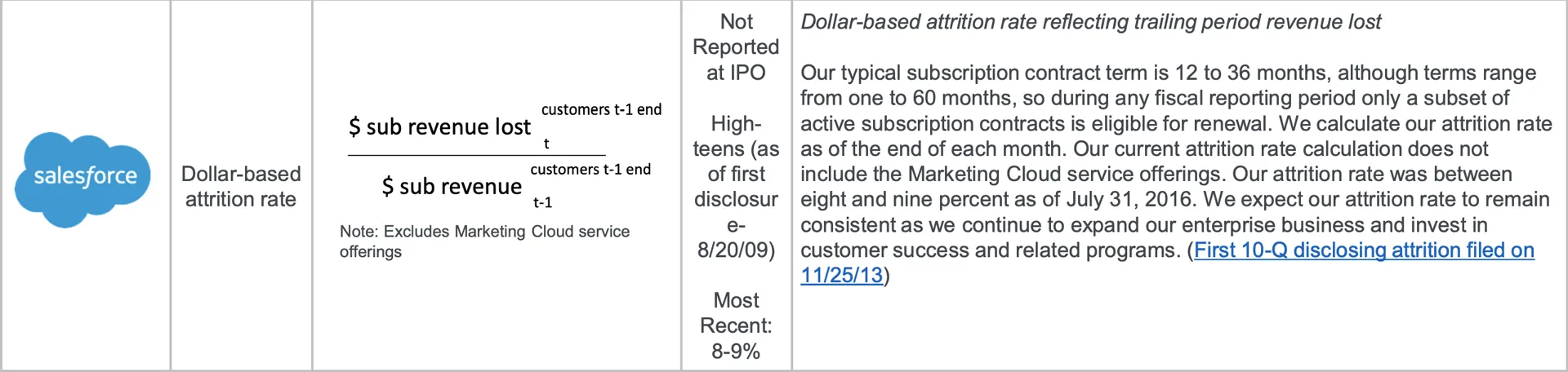

A few examples from a KeyBank report which pulled the net retention methodologies for some well known public companies:

As you can see, different businesses track slightly different variations of net dollar retention – and rightly so. How you define and track the basis, upsells, renewals, revenue, new customers, period, and more is highly dependent on the type of business. Sometimes companies switch the way they report these numbers: often because of business changes (i.e. moving from on-prem to cloud-only offerings), but every once in a while to sugarcoat the numbers.

You can see the full analysis here – it's pretty interesting.